5th Third Lender auto loans immediately

Really Fifth 3rd Lender car finance recommendations try white towards guidance, because financial is not too clear about their financing details. To see what type of auto loan you could potentially be eligible for, you’re going to have to make a phone call or visit a part.

When you are 5th 3rd Financial also offers a wide range of mortgage fees terminology, you will find far more transparency along with other lenders.

- Autopay dismiss: The financial institution also provides a great 0.25% write off with the rates to possess re-finance users exactly who sign up for autopay.

- Zero preapproval available: In place of very car loan providers, 5th 3rd Lender does not supply the possible opportunity to get preapproved to possess an auto loan.

- Zero online software: If you wish to make an application for a car loan, you’ll have to go to an actual branch otherwise pertain over the mobile phone.

- Exterior refinance dismiss: 5th Third Lender tend to re-finance a unique auto loans, but if you will be refinancing financing regarding an alternate financial, you’ll be able to be eligible for an excellent 0.25% rate dismiss.

- Perfect for individuals exactly who choose an in-individual sense: If not such as the concept of trying to get that loan on the web, Fifth Third Lender has the benefit of a classic app process that lets you affect a customer care user every step of one’s ways. However, individuals which prefer an online experience should look elsewhere.

5th 3rd Lender pros and cons

Like any economic choice, taking right out a car loan having 5th 3rd Financial has its positives and negatives. Here you will find the factors you need to know before signing on the dotted range:

With loan number ranging from $2,000 so you can $80,000 and you will mortgage conditions away from a dozen to 75 days, you have even more possibilities during the loan selection than might rating that have additional lenders. And additionally, the lending company also provides a good 0.25% Apr write off once you create automatic costs out of an excellent coupons or bank account.

On the other hand, 5th 3rd Lender cannot bring loan preapproval, which should be difficult to determine if you are able to be eligible for certainly one of its loans. Additionally, you will pay money for credit out-of 5th Third. The car finance has an upfront origination fee that not all lenders fees.

A close look within Fifth 3rd Financial auto loans

Fifth 3rd Lender now offers loans for new and made use of autos. Refinancing is additionally offered, and while Fifth 3rd have a tendency to refinance its automotive loans, the financial institution will provide good 0.25% speed disregard when you re-finance a loan off another bank.

Beyond those people info, the financial institution isn’t really very transparent. There isn’t any public records offered from the interest levels, loan wide variety, tips be considered or exactly what borrowing users is actually recognized.

New bank’s are accountable to the new Ties and Change Payment (SEC) revealed that singular% out-of Fifth 3rd auto individuals got fico scores lower than 660. Meanwhile, 79% had many 720 or more. Nonetheless, those individuals number aren’t shocking once the Fifth 3rd might have been recognized to own providing so you’re able to higher net-value members.

Unfortunately, mortgage preapproval is not available at Fifth 3rd Financial and you’ve got to utilize directly or over the telephone.

Rates deals

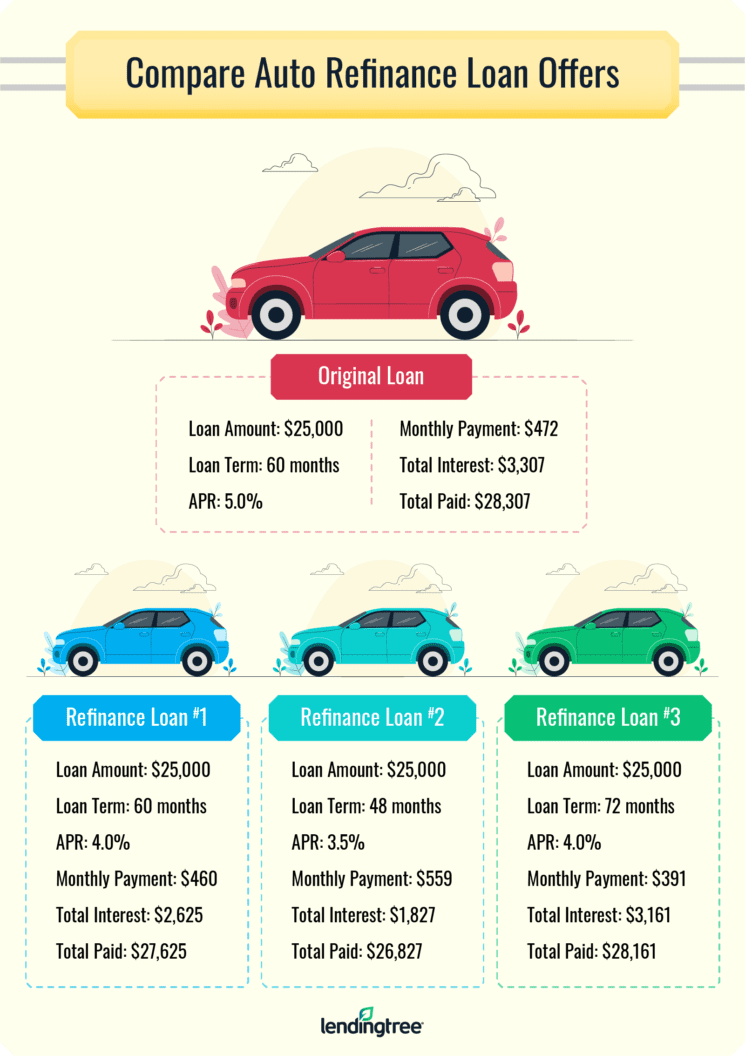

If you are searching to help you refinance your car loan, you can aquire a beneficial 0.25% write off out-of your own interest rate after you refinance a loan of an alternative lender. Because of the signing up for autopay, it’s also possible to located an additional 0.25% discount.

The bank’s webpages also says that consumers with a popular Savings account that have 5th 3rd can also be be eligible for additional loan professionals, however the precise facts out of people professionals commonly given. Its value listing your needed to features at least $100 http://www.paydayloanalabama.com/abbeville/,000 into the mutual bank account dumps and you can capital dumps into the financial so you’re able to qualify for a preferred Savings account, and also make those people extra professionals unreachable to a lot of individuals.

Percentage independence

Other help is generally accessible to individuals who are shedding behind on their mortgage money, and if you’re having trouble checking up on the monthly obligations, get in touch with Fifth Third Bank directly to explore the options.

Restricted access

- Fl

- Georgia

- Illinois

- Indiana

The way to get that loan with 5th Third Lender

Sadly, there isn’t much clearness as much as the way to get an auto loan that have 5th 3rd Financial. Applications are only accepted personally or over the telephone – there isn’t any on the web app processes provided with Fifth 3rd Lender.

Exactly how 5th 3rd Financial automotive loans contrast

Such as Fifth Third Bank, Huntington Lender and you may KeyBank is actually local loan providers. Both KeyBank and you may Huntington Bank allows you to make an application for an auto loan on the web, if you find yourself 5th 3rd Bank means a phone call otherwise a branch stop by at start a loan application